Starting October 6th, Stripe is automatically enabling a new payment option within Link that could change how your customers pay—and how much you spend on processing fees. Instant Bank Payments in Link combines the cost savings of bank transfers with the speed and reliability your customers expect from credit cards.

If you’re already using Link in your WooCommerce store, this feature will appear automatically for your US customers. If you’re not using Link yet, this might be the perfect time to enable it.

What Are Instant Bank Payments?

Think of Instant Bank Payments as the best of both worlds: the lower costs of ACH bank transfers combined with the instant confirmation of credit card payments. Your customers can pay directly from their US bank account through Link, and you’ll receive immediate confirmation that the payment went through—no more waiting days to find out if a bank payment will clear.

The key difference from traditional ACH payments is speed and certainty. Where standard bank transfers can take up to four days for confirmation and leave you wondering if they’ll actually succeed, Instant Bank Payments are confirmed immediately and guaranteed to settle within two business days.

Stripe handles all the complexity behind the scenes, using machine learning models trained on hundreds of billions of dollars in payment data to predict and prevent failed transactions. This means you get the operational simplicity of card payments with the cost savings of bank payments.

The Cost Savings Are Real

Here’s where things get interesting for your bottom line. Instant Bank Payments cost 2.6% + 30¢ per successful transaction—significantly less than typical credit card processing fees.

Let’s put that in perspective. If your average credit card processing rate is 2.9% + 30¢, and you process $50,000 in monthly sales, switching even 20% of those transactions to Instant Bank Payments would save you about $60 per month, or $720 annually. For higher-volume stores, those savings compound quickly.

The beauty is that customers choose their preferred payment method. You’re not pushing anyone away from cards—you’re simply offering a lower-cost alternative that many customers actually prefer.

How Your Customers Will Experience It

From your customer’s perspective, paying with Instant Bank Payments feels remarkably similar to any other Link transaction. When they reach checkout and see Link as an option, they can choose to pay with their bank account or with a card.

For first-time users, the process takes just a few clicks to securely connect their bank account. Link handles the verification and setup seamlessly. For returning customers who have already saved their bank details in Link, it’s truly one-click payment.

What makes this particularly powerful is that Link works across the entire internet. A customer who sets up bank payments on any Stripe-powered store can use those same saved details on your WooCommerce site. This cross-platform memory means you benefit from Link adoption happening everywhere, not just on your store.

Three Ways Link Works in Your WooCommerce Store

If you’re not currently using Link, or if you want to maximize the benefit of Instant Bank Payments, it’s worth understanding the three different ways you can enable Link with our Stripe plugin:

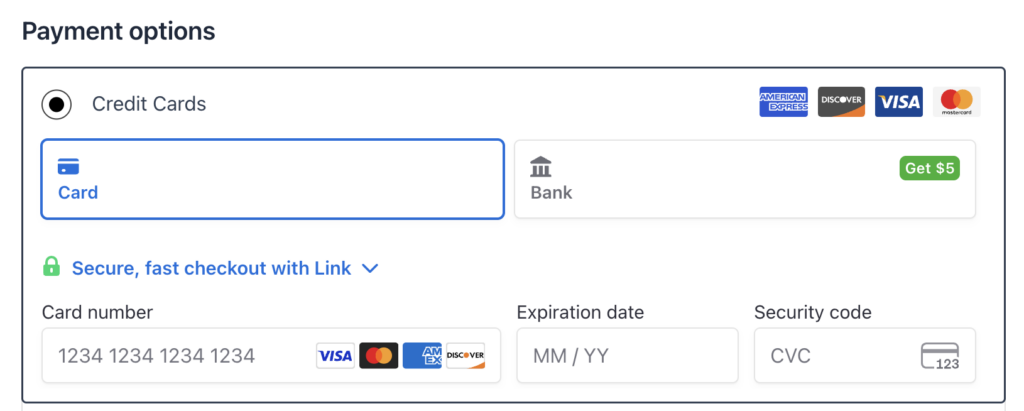

1. Credit Card Integration On your Credit/Debit Cards settings page, the “Faster Checkout With Link” option integrates Link directly into your standard card payments flow. This is where the magic happens with Instant Bank Payments—when customers reach the payment section, they’ll see both card and bank payment options side by side. Returning Link users can choose their preferred payment method, whether that’s a saved credit card or their bank account.

Screenshot of the Stripe Payment Form with Link enabled and Instant Bank Payments as an option

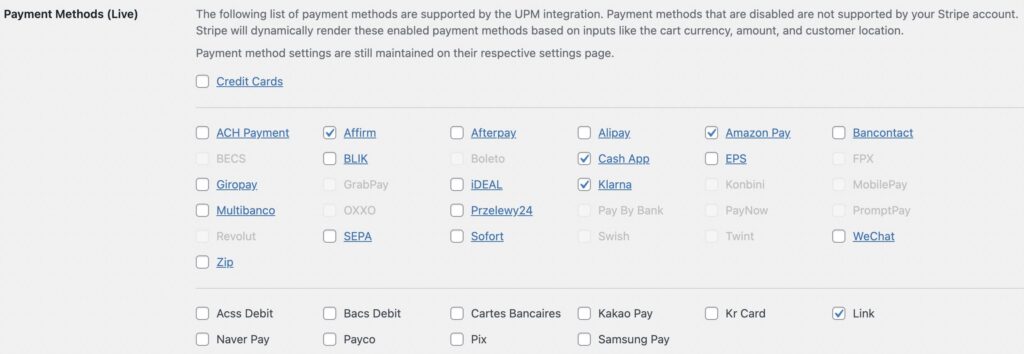

2. Universal Payment Method In your Universal Payment Method settings, you can enable Link alongside all your other payment options. This gives Link equal visibility with methods like Apple Pay, Google Pay, and others.

Screenshot of the payment methods enabled in the Universal Payment Method

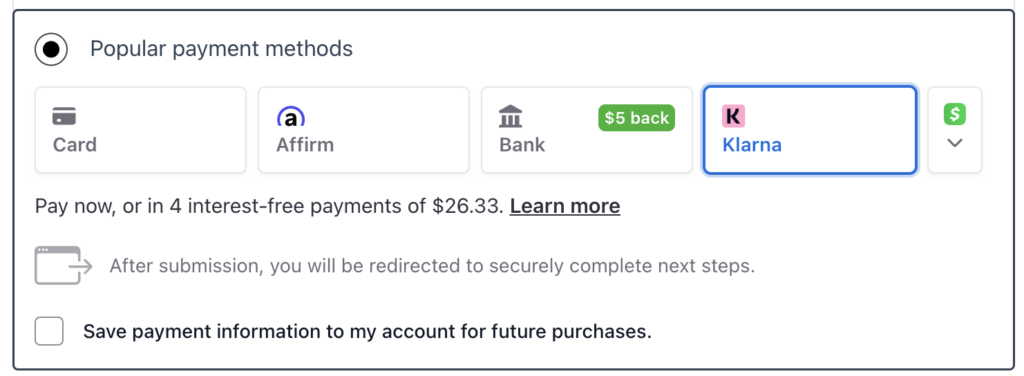

Screenshot showing how the Universal Payment Method appears with Link Instant Bank Payments

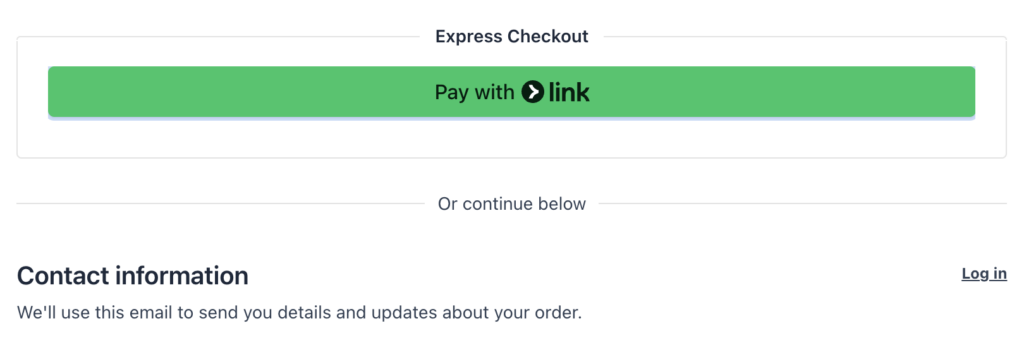

3. Express Checkout Link can appear as an express checkout button on product pages, cart pages, and checkout pages—similar to how Apple Pay and Google Pay work. This allows customers to bypass the entire checkout form for truly one-click purchasing.

You can use any combination of these three approaches. Many merchants enable all three to give customers maximum flexibility in how they want to pay.

Why Stripe is Confident Enough to Enable This Automatically

Stripe’s decision to automatically enable Instant Bank Payments for all US merchants signals their confidence in the technology. This isn’t a beta feature they’re asking you to test—it’s a mature payment method they’re rolling out universally.

That confidence comes from processing billions of dollars in ACH transactions and developing machine learning models that can predict payment success with remarkable accuracy. By guaranteeing these payments even if they’re later returned by the bank, Stripe is essentially removing all the traditional risks associated with bank payments.

For you, this means getting the benefits of lower processing costs without any of the usual headaches of managing ACH returns, failed payments, or delayed confirmations.

Part of Stripe’s Broader Link Strategy

Instant Bank Payments represent more than just another payment option—they’re part of Stripe’s strategic expansion of the Link network to include high-converting payment methods that benefit both merchants and customers.

By adding bank payments to Link, Stripe is creating a more comprehensive payment ecosystem where customers have genuine choice in how they pay. This isn’t about pushing customers away from cards, but rather about expanding the options available while potentially reducing your processing costs.

The beauty of this approach is that it’s entirely customer-driven. Customers who prefer the lower fees and direct bank connection will choose Instant Bank Payments, especially with the $5 cash-back incentive Stripe is offering to first-time bank payers (funded entirely by Stripe, not you). Customers who prefer cards can continue using cards exactly as they always have.

For merchants, this means you’re not changing anyone’s preferred payment method—you’re simply expanding the toolkit of payment options that Link provides, with the added benefit of potentially lower processing rates on transactions where customers choose to pay by bank.

What to Expect Starting October 6th

When this feature goes live, you won’t need to change anything about how you operate your store. Orders paid with Instant Bank Payments will appear in your Stripe Dashboard just like any other Link payment, with clear notation of the payment method used.

The settlement timeline matches what you’re used to with cards: payments are confirmed instantly, and funds are available in your account within two business days. Your existing reporting, reconciliation, and customer service processes all work exactly the same way.

The Bigger Picture: Payment Evolution

Instant Bank Payments represent something larger than just another payment option. They’re part of a broader shift toward giving both merchants and customers more choice in how transactions happen.

For merchants, this means more tools to optimize for both conversion and profitability. For customers, it means more ways to pay using their preferred method. And for the industry, it represents the kind of innovation that makes commerce more efficient for everyone.

The fact that this is launching automatically, with no action required from you, makes it an easy win. Your customers get more payment flexibility, you get access to lower processing costs, and everyone benefits from the improved checkout experience that Link provides.

Whether you’re already using Link or considering it for the first time, Instant Bank Payments add another compelling reason to offer this checkout option to your customers. In a competitive e-commerce environment, giving customers more ways to pay—especially ways that also save you money—is the kind of advantage that compounds over time.